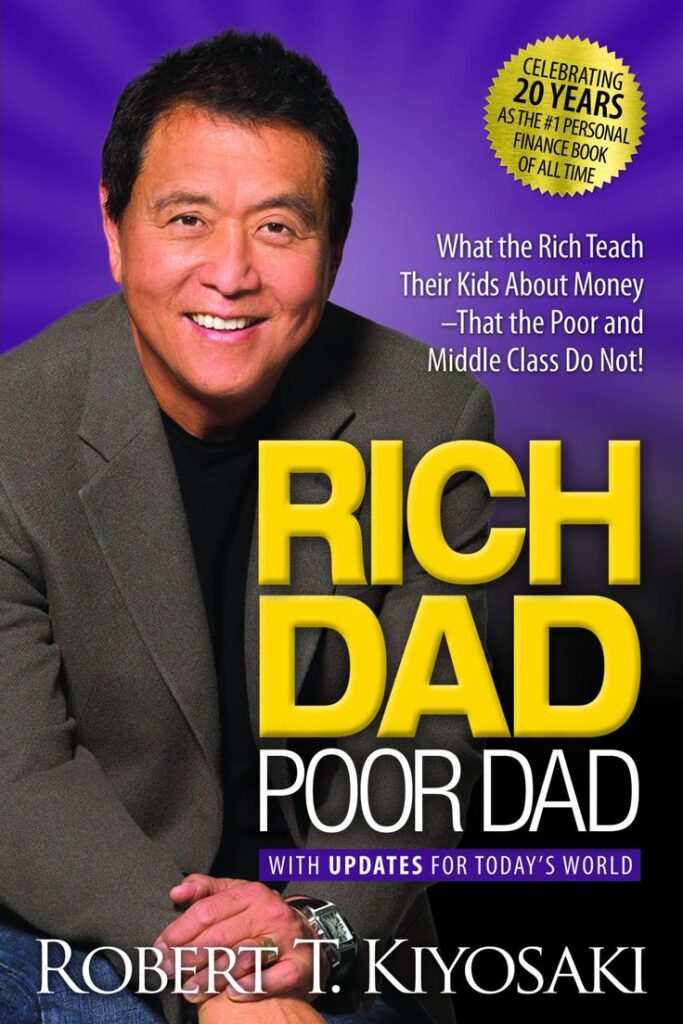

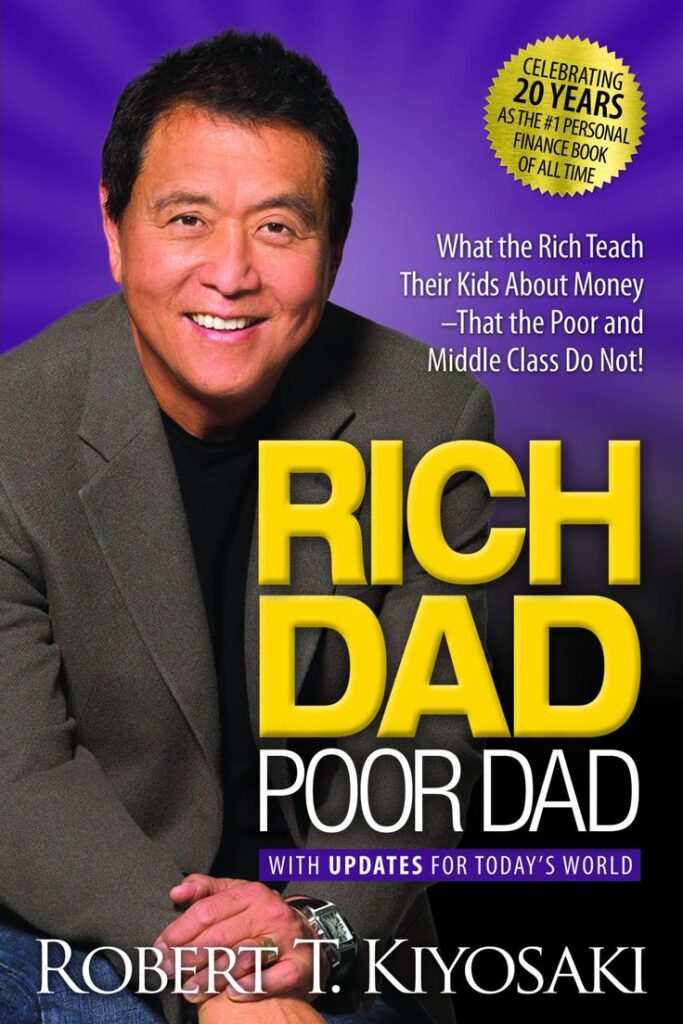

Rich Dad Poor Dad Unlocking Financial Wisdom – 2024 Update

Rich Dad Poor Dad

“Rich Dad, Poor Dad” by Robert Kiyosaki is more than just a book; it’s a guide to financial transformation. In a world where financial literacy is often overlooked, Kiyosaki’s masterpiece stands as a beacon, illuminating the path to financial success. Let’s delve into the key teachings and principles that make “Rich Dad, Poor Dad” a timeless treasure.

Who is the rich dad?

In the pages of “Rich Dad, Poor Dad,” one encounters the enigmatic figure of the Rich Dad. Rich Dad, a mentor and guide, is not just a character but a symbol of financial wisdom. Kiyosaki shares invaluable lessons from this influential figure, emphasising the importance of thinking differently about money and wealth.

Who is the poor dad?

Contrasting sharply with the rich dad is the poor dad, representing conventional beliefs about money and success. Through the experiences of his biological father, Kiyosaki illustrates the contrasting philosophies that shape financial destinies. The divergent paths taken by the two dads serve as a powerful narrative device to drive home crucial financial insights.

Financial education matters.

At the heart of “Rich Dad, Poor Dad” lies a profound truth: the significance of financial education. Kiyosaki advocates for a financial education that goes beyond traditional schooling, empowering individuals to make informed decisions about money. The book challenges the conventional notion that formal education alone guarantees financial success.

Assets vs. liabilities

One of the fundamental concepts presented by Rich Dad is the understanding of assets and liabilities. In a world often driven by materialism, Kiyosaki’s distinction between assets that put money in your pocket and liabilities that take money out is a game-changer. Real-life examples make these principles practical and applicable for readers of all financial backgrounds.

Creating passive income streams

“Rich Dad, Poor Dad” introduces the concept of passive income as a key to financial freedom. The book guides readers on how to make money work for them, providing a roadmap to create sustainable income streams that require minimal effort. The shift from active income to passive income is a paradigm shift that can lead to lasting financial success.

Importance of Entrepreneurial Mindset

Rich Dad’s entrepreneurial mindset is a cornerstone of the book. Kiyosaki encourages readers to embrace an entrepreneurial spirit, viewing challenges as opportunities for growth. By fostering a mindset that seeks solutions and takes calculated risks, individuals can navigate the complex world of finance with confidence and creativity.

Investing Wisely

“Rich Dad, Poor Dad” offers invaluable insights into the world of investing. Rich Dad’s principles guide readers in making informed investment decisions, emphasising the importance of education and research. Whether in stocks, real estate, or businesses, the book provides a foundation for building a robust investment portfolio.

Real estate as an investment

Real estate holds a special place in Rich Dad’s financial playbook. Kiyosaki explores the pros and cons of investing in real estate, highlighting its potential for generating passive income and long-term wealth. The book’s practical advice on real estate serves as a valuable resource for those looking to diversify their investment portfolio.

Overcoming financial obstacles

“Rich Dad, Poor Dad” addresses common financial challenges with practical solutions. From debt management to navigating economic downturns, the book offers insights that empower individuals to overcome obstacles on their path to financial success. The importance of resilience and adaptability is a recurring theme throughout the book.

The Role of Risk-Taking

Risk-taking is a concept often misunderstood in the realm of finance. Rich Dad’s approach to risk involves making calculated decisions and learning from failures. “Rich Dad, Poor Dad” encourages readers to embrace a healthy attitude towards risk, viewing it as an essential element in the journey to financial prosperity.

Legacy and Generational Wealth

A unique aspect of “Rich Dad, Poor Dad” is its emphasis on legacy and generational wealth. Kiyosaki guides readers on how to build a financial legacy that can benefit future generations. By instilling financial literacy in family traditions, individuals can break the cycle of financial struggle and create a lasting impact.

Applying “Rich Dad, Poor Dad” Principles

The true value of “Rich Dad, Poor Dad” lies in its practical applicability. The book doesn’t just impart knowledge; it provides actionable steps for readers to implement in their lives. Success stories from individuals who have applied these principles serve as inspiration for those embarking on their financial education journey.

Common Misconceptions

As with any influential work, “Rich Dad, Poor Dad” has its share of misconceptions. Addressing these misconceptions is essential for a nuanced understanding of the book’s teachings. By clarifying key concepts, readers can avoid pitfalls and fully grasp the transformative potential of Kiyosaki’s insights.

PLEASE VISIT:

Conclusion

In conclusion, “Rich Dad, Poor Dad” serves as a timeless guide for anyone seeking financial empowerment. Its teachings extend beyond conventional financial advice, providing a roadmap for creating lasting wealth and financial freedom. As you embark on your financial education journey, remember the lessons of Rich Dad and the invaluable wisdom imparted by Robert Kiyosaki.

What is “Rich Dad, Poor Dad” about?

- “Rich Dad, Poor Dad” is a personal finance and self-help book written by Robert T. Kiyosaki. It contrasts the financial philosophies and practices of two father figures—Kiyosaki’s biological father (referred to as “poor dad”) and the father of his childhood best friend (referred to as “rich dad”).

What are the key lessons from “Rich Dad, Poor Dad”?

- The book emphasises the importance of financial education, building assets, and investing in order to achieve financial independence. It challenges conventional beliefs about money and encourages readers to think differently about wealth-building.

Who are Rich Dad and Poor Dad in the book?

- Rich Dad is the father of Kiyosaki’s childhood friend, and he represents the mindset of a successful entrepreneur and investor. Poor Dad is Kiyosaki’s biological father, a well-educated man who follows traditional career and financial paths.

Is “Rich Dad, Poor Dad” only for entrepreneurs?

- While the book does promote an entrepreneurial mindset, its principles are applicable to anyone seeking financial independence. The focus is on understanding money, making informed financial decisions, and investing wisely.

Does the book provide practical advice for managing finances?

- Yes, the book offers practical advice on budgeting, investing, and understanding the difference between assets and liabilities. It encourages readers to take control of their financial education and make informed decisions.

Are there criticisms of “Rich Dad, Poor Dad”?

- Some critics argue that the book lacks specific investment advice and that the narrative style may oversimplify complex financial concepts. However, many readers appreciate the book for its motivational and mindset-changing aspects.

Is “Rich Dad, Poor Dad” suitable for beginners in finance?

- Yes, the book is designed to be accessible to readers with varying levels of financial knowledge. It introduces fundamental concepts in a straightforward manner, making it a good starting point for those new to personal finance.